Futa Rate 2025. The standard futa tax rate is 6.0% on the first $7,000 of wages per employee each year. Learn more about the futa tax from the irs , and work with a qualified tax preparer to submit the.

The futa tax rate as of 2025 is 6% of the first $7,000 of each employee’s wages during the calendar year. Learn more about the futa tax from the irs , and work with a qualified tax preparer to submit the.

States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa).

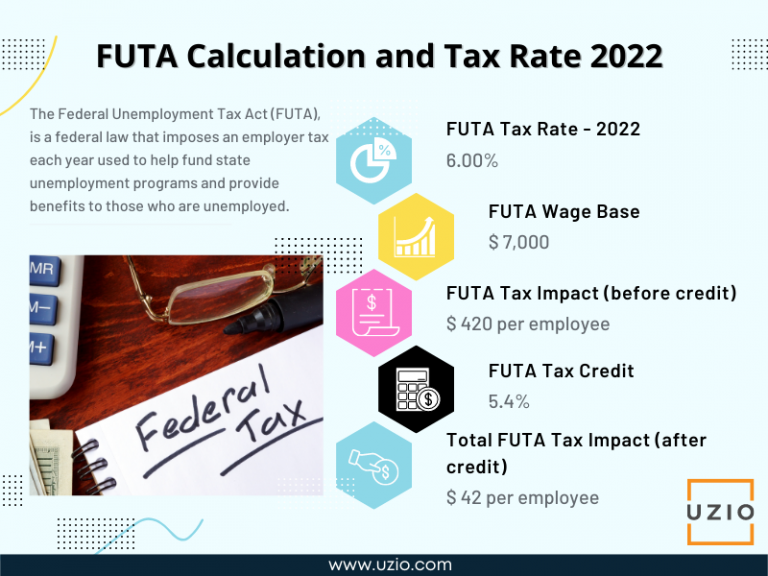

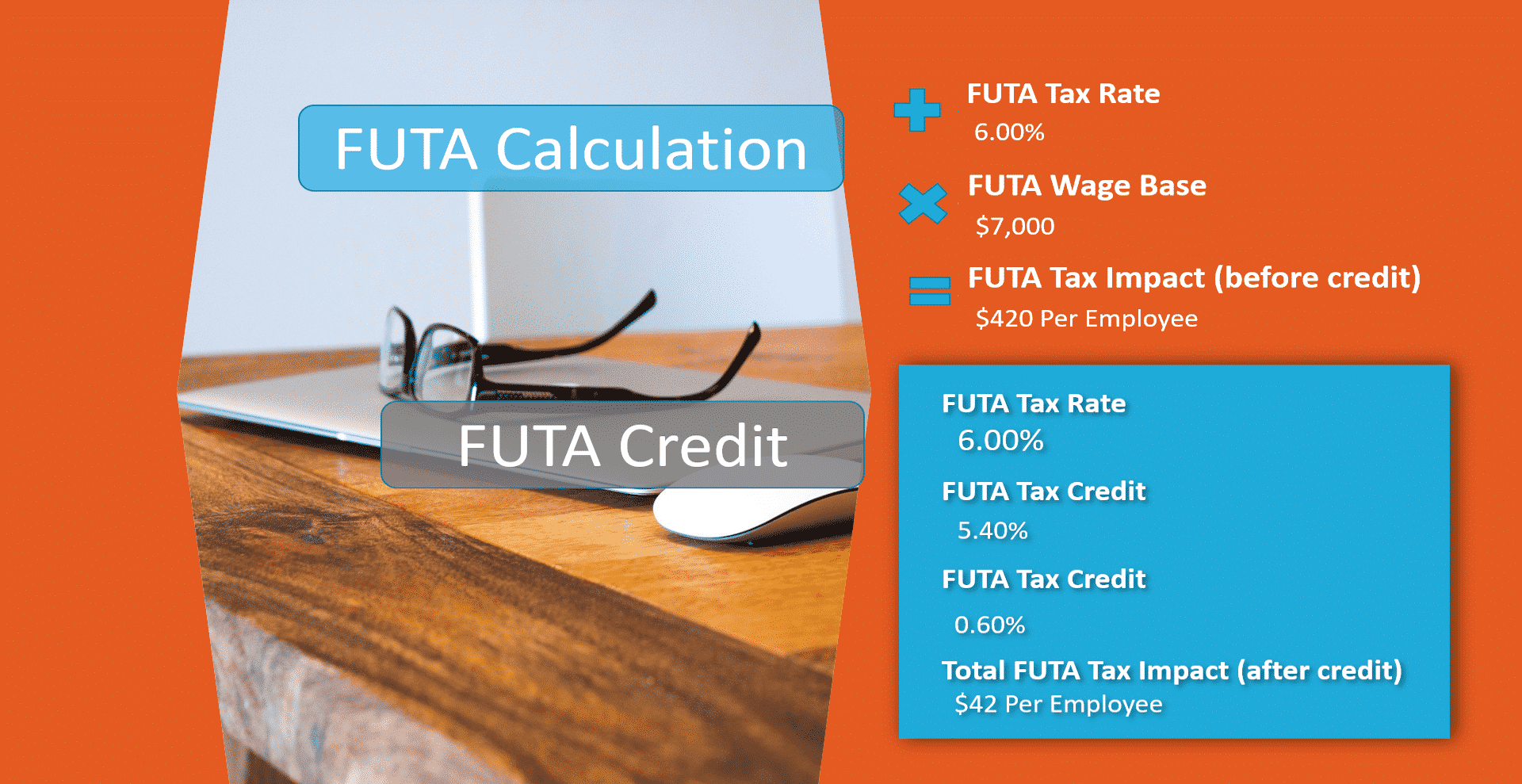

FUTA Tax How to Calculate and Understand Employer’s Obligations UZIO Inc, Learn more about the futa tax from the irs , and work with a qualified tax preparer to submit the. The futa rate for 2025 is 6.0% of the first $7,000 in wages for all employees, or approximately $420 per employee (assuming every employee makes at least $7,000 per.

FUTA Tax Rate 2025, The futa tax rate is 6% of an employee’s wages up to $7,000—any amount above the taxable wage base of $7,000 is not considered taxable wages for futa. Therefore, employers shouldn't pay more than $420 annually for each employee (6.0% x.

FUTA Tax Rate 2025 Unemployment Zrivo, Social security and medicare tax for 2025. Employee 3 has $37,100 in eligible futa wages, but futa applies.

What is FUTA? Federal Unemployment Tax Rates and Information for 2025, This means that the percentage of wages that employers, including tax. The social security wage base limit is $168,600.the medicare tax rate is.

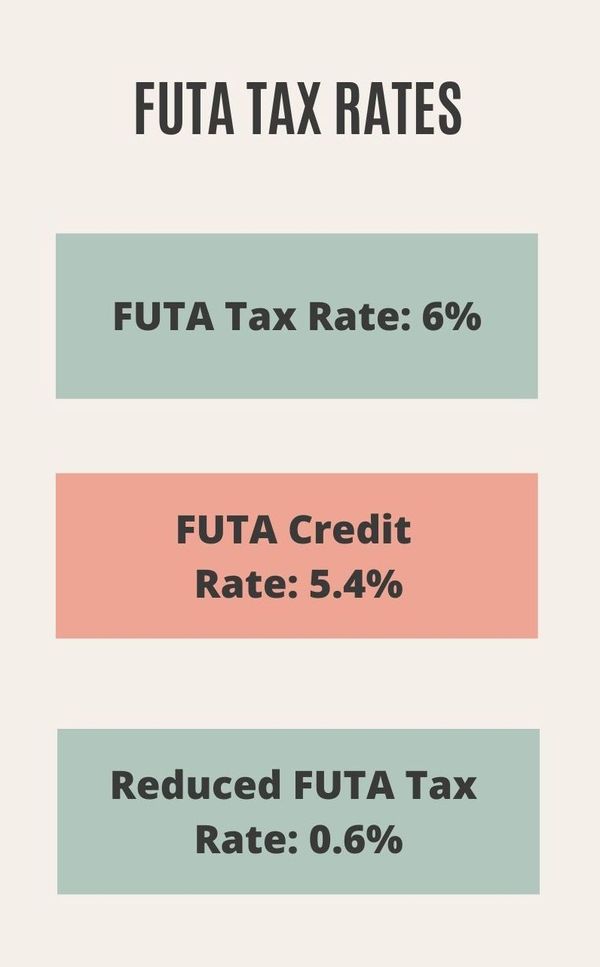

Federal Unemployment Tax Act (FUTA) Definition & Calculation, The instructions for schedule a (form 940) confirm the dol’s announcement that employers in both states will be subject to a 0.6% credit reduction and employers in. The social security wage base limit is $168,600.the medicare tax rate is.

Futa suta calculator SyiaraMercy, New interest rates hdfc bank is offering special interest rates of 7.20 percent on fds with a tenure of 35 months. Learn more about the futa tax from the irs , and work with a qualified tax preparer to submit the.

How Is Futa Calculated, As a result, california is experiencing an additional 0.3% in their futa credit reduction rate, which means employers in 2025 will have to pay a higher futa rate of 0.6% total,. Social security and medicare tax for 2025.

Complete Guide to FUTA tax, The futa rate for 2025 is 6.0% of the first $7,000 in wages for all employees, or approximately $420 per employee (assuming every employee makes at least $7,000 per. Together with state unemployment tax systems, the.

form940instructionsfutataxrate202106 pdfFiller Blog, This means that the percentage of wages that employers, including tax. The standard futa tax rate is 6.0% on the first $7,000 of wages per employee each year.

form940instructionsfutataxrate2021featured pdfFiller Blog, The social security wage base limit is $168,600.the medicare tax rate is. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa).