Updated Tax Table 2025. Having the right tax tables for your payroll is imperative to ensure. In the u.s., there are seven federal tax brackets.

The following are key aspects of federal income tax withholding that are unchanged in 2025: We’re sorry but myirc doesn’t work properly without javascript enabled.

Tax rates for the 2025 year of assessment Just One Lap, As of january 29, the irs is accepting and processing tax returns for 2025. For 2025, individuals who file taxes as single and have incomes over $609,350 ($731,200 for married filing jointly) will pay a top rate of 37%.

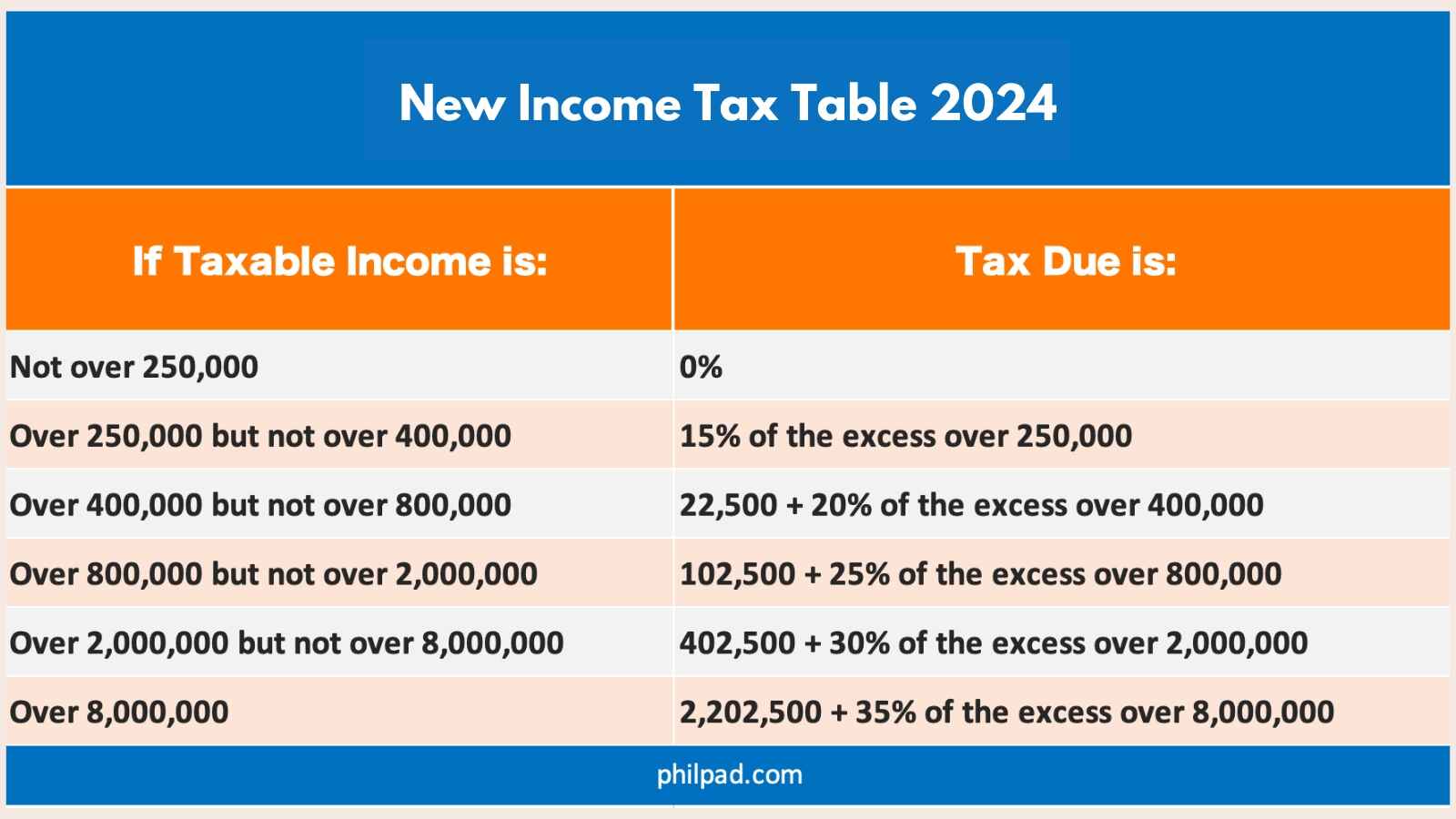

New Tax Table 2025 Philippines (BIR Tax Table), Your bracket depends on your taxable income and filing status. [monthly tax deductions from regular profits from employment] how to apply table 1 table 1.

10+ Calculate Tax Return 2025 For You 2025 VJK, Step by step irs provides tax inflation adjustments for tax year 2025 full. For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Withholding Tax Table effective January 1, 2025 — GABOTAF, Step by step irs provides tax inflation adjustments for tax year 2025 full. The new income tax rates from year 2025 onwards, as per the train law, are as follows.

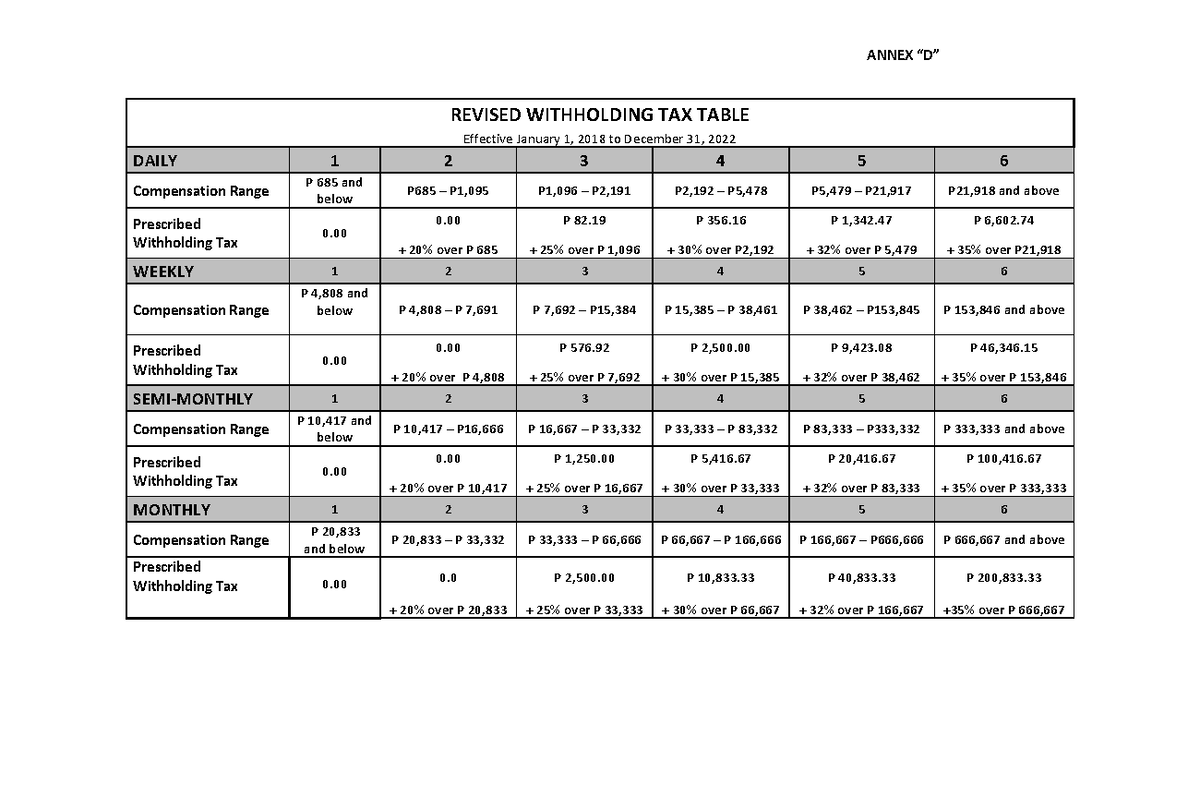

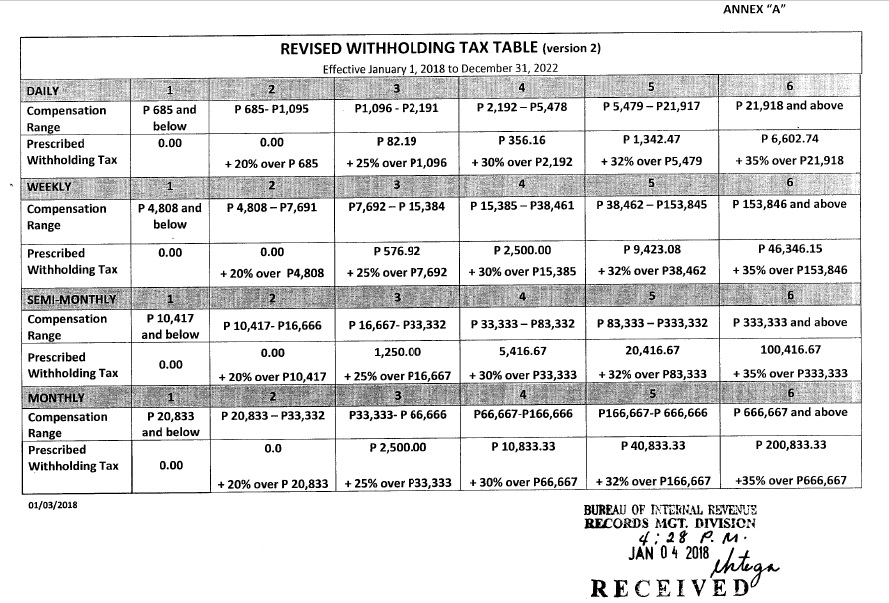

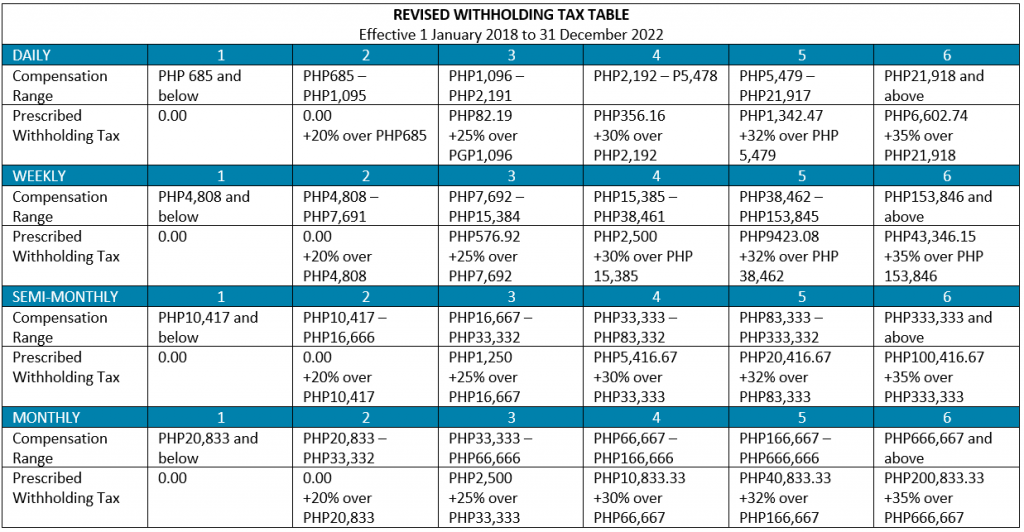

RR112018 AnnexD RevisedWithholdingTaxTable 20182022 (Philippines, Which provincial or territorial tax table should you use? In the u.s., there are seven federal tax brackets.

TRAIN Series Part 4 Amendments to Withholding Tax Regulations ZICO Law, The marginal rates — 10%, 12%, 22%, 24%, 32%, 35% and 37% — remain unchanged from 2025. Hi sls3, i can understand your concern, when your first payroll is scheduled for january 3, 2025.

RB20221010 New BIR Tax Tables Effective January 1, 2025 Titanium, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Revised Withholding Tax Table Bureau of Internal Revenue, The income tax rates and personal allowances in colorado are updated annually with new tax tables published for resident and non. The agency expects more than 128 million returns to be filed before.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. New philhealth contribution table 2025.